After December I generally find Januarys easy to handle, at least in the financial sense. This January was no exception. This is where my accounts stand:

| Liquid Assets |

Dec-16 |

Jan-17 |

$ Change |

| Cash & Savings |

$832 |

$1,200 |

+$368 |

| Emergency Fund |

$1,500 |

$2,501 |

+$1,001 |

| Short Term Savings |

$0 |

$75 |

+$75 |

| Long-Term Savings |

$0 |

$43 |

+$43 |

| Other |

$290 |

$303 |

+$13 |

| Illiquid Assets |

Dec-16 |

Jan-17 |

$ Change |

| Savings Bonds |

$0 |

$500 |

+$500 |

| Roth IRA |

$11,756 |

$12,824 |

+$1,068 |

| Traditional 401K |

$11,521- |

$13,126 |

+$1,605 |

| Liabilities |

Dec-16 |

Jan-16 |

$ Change |

| Credit Cards |

$0 |

$0 |

+$0 |

| Medical |

($175) |

($100) |

+$75 |

| Net Worth |

$25,724 |

$30,472 |

+$4,748 |

| % Change |

+18.5% |

Liquid Assets:

According to my Goal post , if everything went as planned in January, my liquid assets should have increased by $1,950. Collectively, my Liquid Assets increased by exactly $1,500 – $450 below target. The main reason why I missed this target is due to transfers into illiquid savings. I contributed a bit extra to my Roth IRA and I decided to turn towards i-savings bonds. When these are taken into account I actually saved and invested $2,165.

One change to my financial plan is the fact that I opened accounts for my short and long term savings goals. I will make a post on what these goals are soon. My long term savings will eventually be transferred to a brokerage account.

Illiquid Assets:

The second change in my financial plan is the slow movement of my emergency fund over to i-savings bonds. I haven’t quite figured out my contribution schedule for this yet since I won’t be able to touch these funds for 12 months (this is why they are listed as illiquid right now). But the interest rates are better than banking. I’ll most likely purchase a $500 savings bond with my tax returns.

My retirement accounts increased nicely. As stated in an earlier post, the first two 401K contributions were small the third was $738. Subsequent contributions will continue to be $738 to reach $18,000 by the end of the year.

Liabilities:

I decided not to carry over any credit card debt this month and I would like to get into that habit. I still have medical bills to pay though.

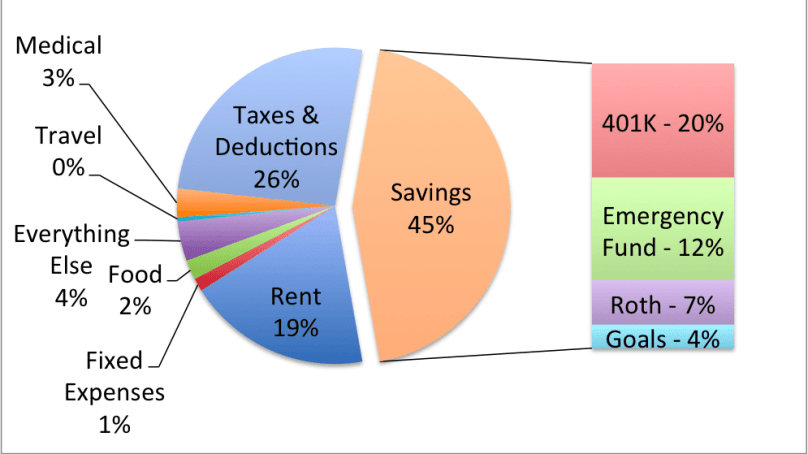

Budget

As I said previously, January tends to be good on the budget. I did change my budget slightly from the beginning of the month. Namely, I increased my “Everything Else” expenses by $300 due to receiving $100 as a late Christmas present and a $200 banking reward.

| Category |

Budgeted |

Actual |

Remaining |

| Rent |

$1,650 |

$1,650 |

$0 left |

| Fixed Expenses |

$100 |

$89 |

$11 left |

| Food |

$200 |

$192 |

$8 left |

| Medical |

– |

$440 |

∞ |

| Travel |

$77 |

$77 |

$0 left |

| Everything Else* |

$373 |

$423 |

$50 over |

| Total |

$2,400 |

$2,431 |

$31 over |

I ended up spending $100 on an Amazon prime membership, and $75 on a toothbrush. I’m hoping the toothbrush saves on some of my dental bills. I gave $25 to a friend and don’t expect it back. I spent the rest here and there on various things, such as booking a hostel for an upcoming trip .

I don’t budget for medical expenses because my health is too important to place an upper limit on my spending.I spent $440 on medical expenses this month but I don’t anticipate that this spending category will affect my net worth for a while due to a well padded FSA and a health based rewards card provided by my insurance company. If I remember correctly it was around April when I depleted my FSA and rewards card last year. My health is much better this year, so I’m hoping they’ll last the entire year

Taxes

I finished up my tax returns this month and it will be larger than anticipated. I should be receiving the federal portion on February 5. I am not sure how long it will take to receive the state portion.

Here is how I plan to allocate my return:

- $500 in Emergency Fund

- $500 in i-Savings Bonds

- $100 in healthcare expenses

- $70 Fun Money

The remainder will go towards my cash buffer in my primary checking account

Conclusions & Next Month

This was an incredible month. I stuck to my game plan and was able to save $215 more than I originally anticipated. Going back to my goal post, with taxes coming up next month, my goal was to increase my liquid assets by $1,125. I am going to roll over the extra savings from this month so I need to increase my liquid assets and savings bond category by $910 to stay on track.

Right now I have $4,622 in liquid assets and savings bonds. My goals now are:

- February Goal: $5500

- February Stretch: $5750

- March Goal: $5750

- March Stretch: $6000